Clearing - Admission phase

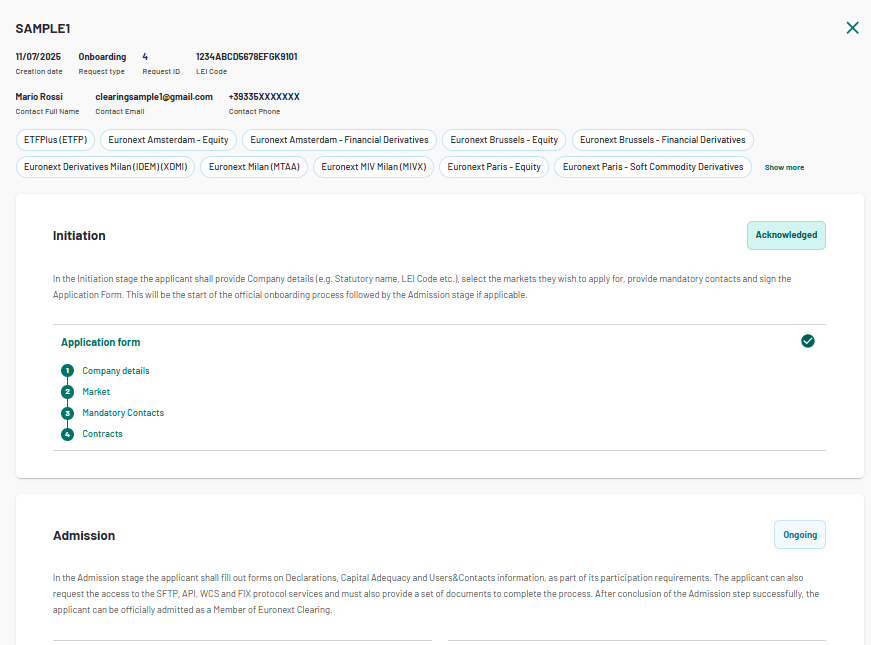

Once the Initiation stage is completed the admission stage starts. From this point forwards the onboarding process will be managed by the registered Authorised Representatives instead of the Prospect User. No further action is required from the Prospect User.

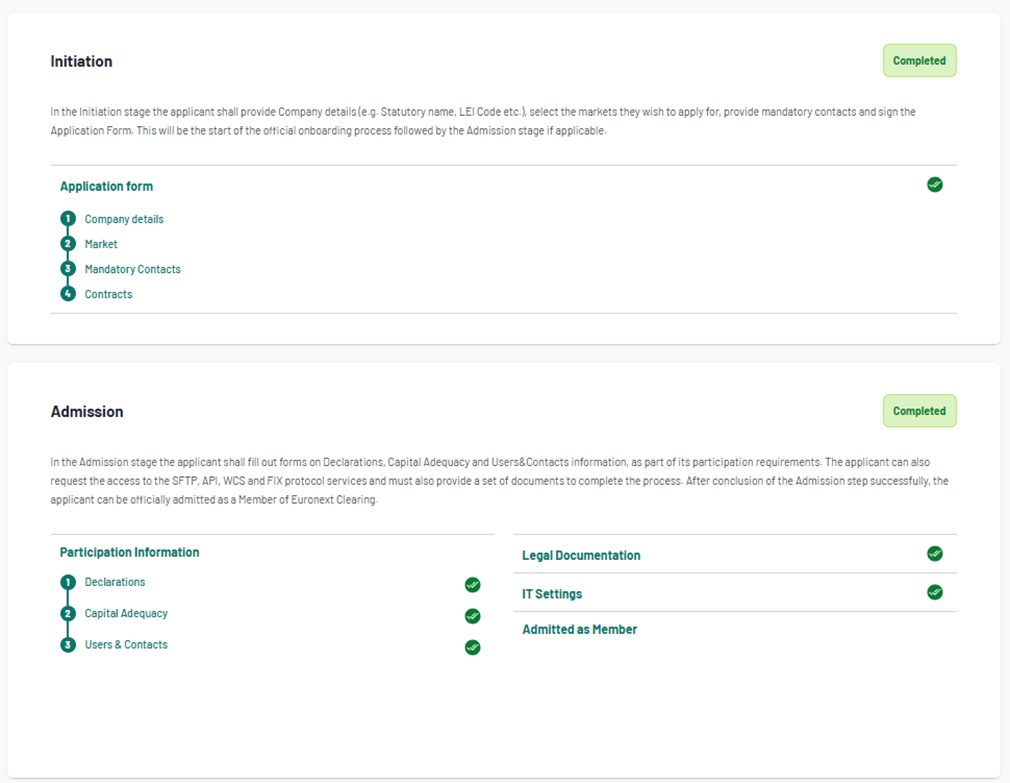

The folder for the Admission stage is displayed to the Authorised Representatives as follows:

In the Admission stage, Authorised Representatives will need to fill out forms on Participation information, Legal documentation and IT settings.

Participation information

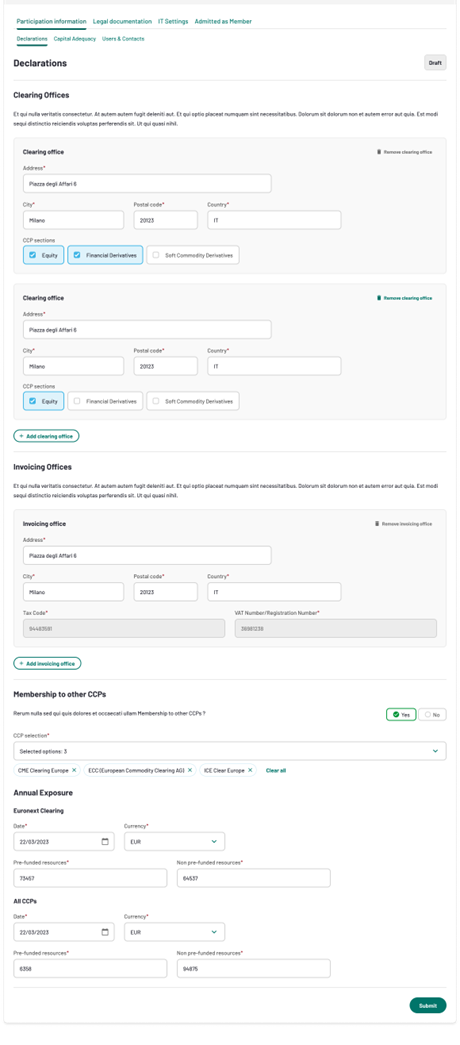

Declarations

The Declarations define the following elements :

- Clearing Offices : Address at which the clearing activities are managed. It could be the same as the registered office and it could be different per Asset Class and CCP section.

- Invoicing Offices : Address at which the invoices are sent.

- CCP section : In this form, you need to indicate the participation to others CCPs and your membership profile

- Annual Exposure : This form has to be filled in by exisiting clearing members once per year at the beginning of the year. It will be prefilled in by Euronext Clearing and clearing members will have to complete the fields by checking the information provided by E.C and adding other exposure in respect to the other CCPs to which they participate.

When the form is submitted, the status will change to Pending Approval :

And it will move to Accepted as soon as the form is accepted by Euronext.

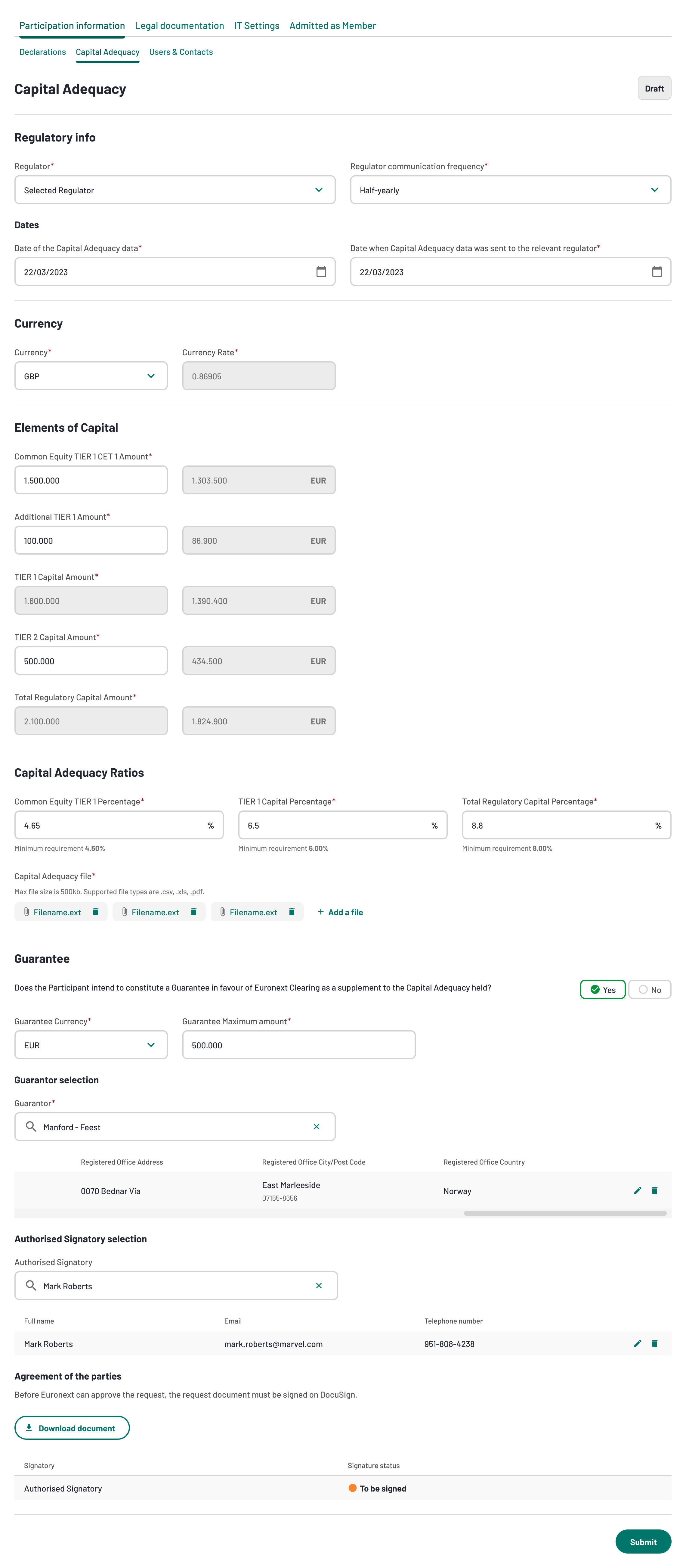

Capital Adequacy

The Capital Adequacy form allows Clearing Members to submit Regulatory Capital to the CCP on a quarterly basis as requested by letter A) of Annexes B.114 and B.114-bis to Euronext clearing Regulations (additional information on such obligation are available on the section Rules & Regulations of the official website of Euronext Clearing). Any update of this form must be performed by an Authorised Representative of the Clearing Member.

The form is structured in four sections: a) Regulatory Info to identify the Relevant authority; b) Currency to ensure proper conversion and consistency of values reported in different currencies; c) Elements of Capital to report the various capital components used to calculate the total regulatory capital; d) Capital Adequacy Ratios to check compliance with capital requirements; e) Guarantee this section is completed if the Clearing Member supplements its capital with a guarantee, detailing the guarantor, authorised signatory, and the signed guarantee document.

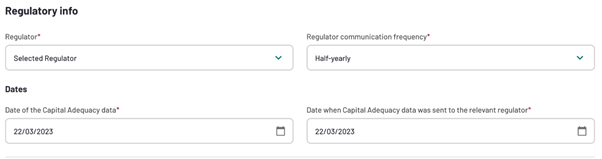

a) Regulatory Info, where the Clearing Member must select the relevant supervisory authority and indicate the frequency of the reporting (e.g., quarterly, semi-annually). Dates, where is required to provide the reference date for the capital adequacy data and the date on which the information was sent to the competent authority;

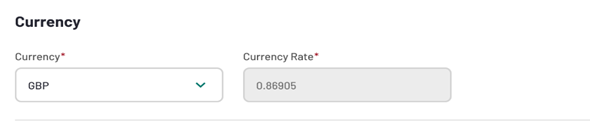

b) Currency, where the Clearing Member must indicate the currency used to report capital figures (e.g., GBP, EUR) and the exchange rate used for conversion, if the capital is originally denominated in currencies different from EUR;

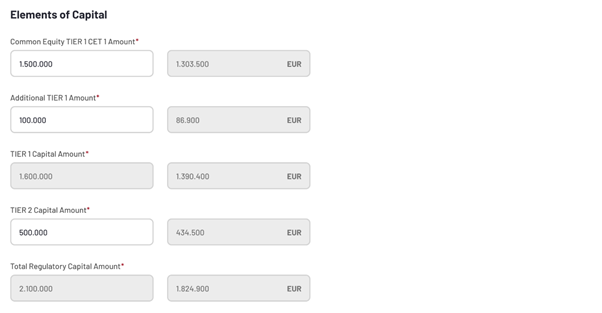

c) Elements of Capital, this section includes the input of the capital amounts, both in original and converted currency, for the following components:

- Common Equity Tier 1 (CET1) ;

- Additional Tier 1 Capital (AT1) ;

- Tier 2 Capital (T2).

- The system automatically calculates Tier 1 Capital, which includes CET1 and AT1, and Total Regulatory Capital by combining Tier 1 and Tier 2 amounts.

d) Capital Adequacy Ratios, where the Clearing Members must provide the calculated ratios:

- CET1 Ratio

- Tier 1 Ratios

- Total Capital Ratio

Each Ratio is then compared with the relevant regulatory minimum.

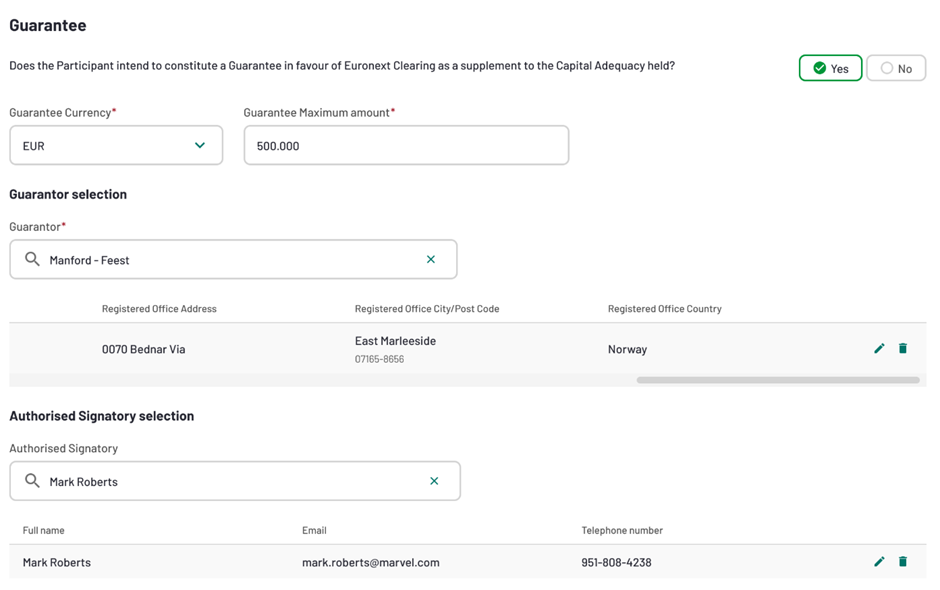

e) Guarantee, Clearing Members with a total regulatory capital level lower than the minimum requirement implied by their membership profile may present a capital adequacy guarantee to support the fulfilment of this minimum requirement.

The following must be provided:

- Whether a guarantee is in place (Yes/No).

- The guarantor entity, chosen from a pre-approved list.

- Detail of the authorised signatory (name, email, phone);

- Upload of the signed guaranteed document

All the figures (Elements of Capital, Capital Adequacy Ratio and Reference dates) submitted by Clearing Members must be supported by appropriate documentation aimed at certifying and double check the data (CET1, AT1, T2, CET1 Ratio, T1 Ratio, Total Regulatory Capital Ratio). The supporting documents must be uploaded under the Capital Adequacy File section (see below image). Multiple files upload is allowed.

Once the Capital Adequacy form is submitted, its status will move from Draft to Pending Approval. It will then be reviewed by Euronext.

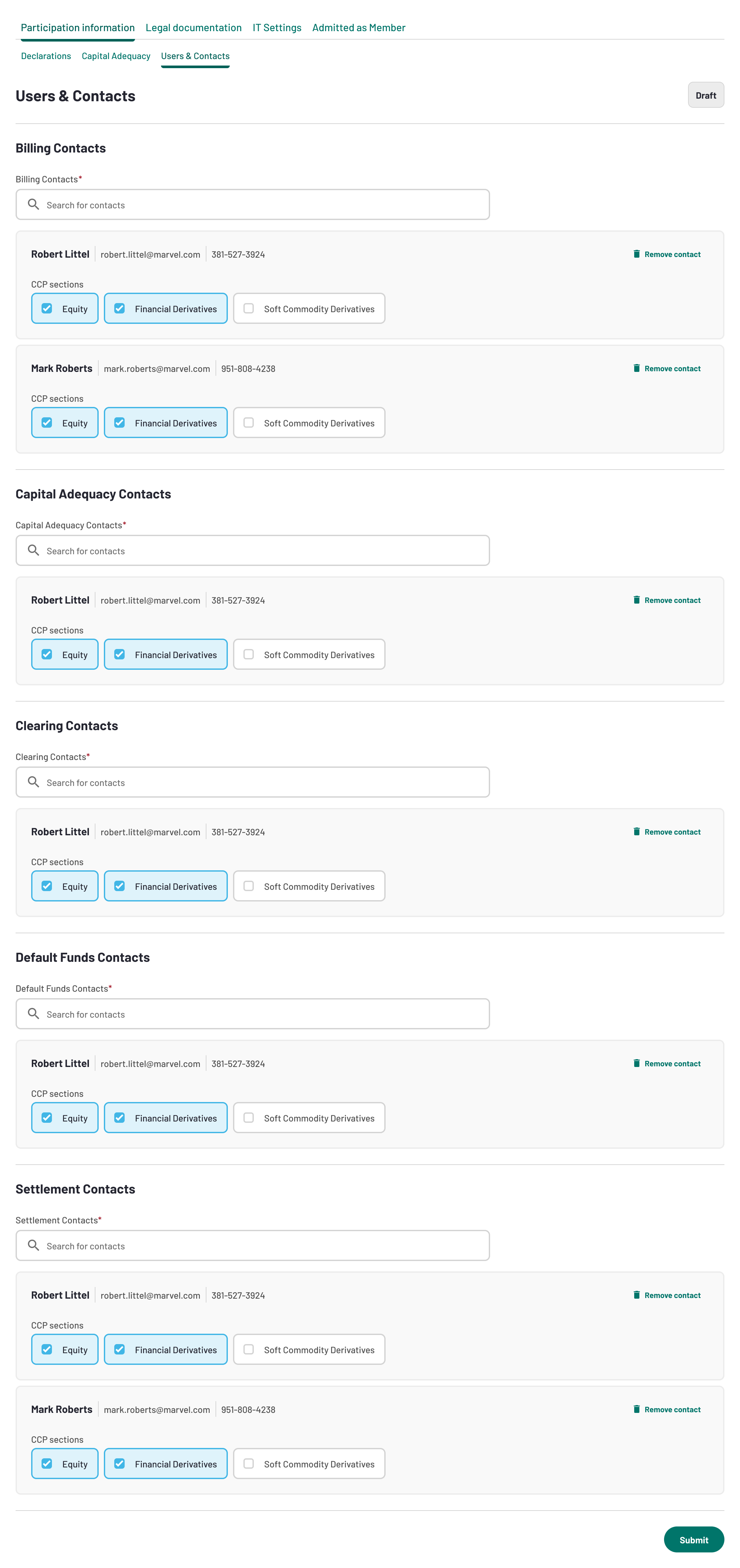

Users and contacts

In this tab the Applicant will need to fill in the details of the contacts mentioned below :

- Billing contacts

- Capital Adequacy contatcs

- Clearing contacts

- Default Fund Contacts

- Settlement Contacts

All users will require a Connect account to access the MyEuronext portal. Therefore, users will have to create an account on Connect by following the steps described here.

When the form is submitted, the status will change to Pending Approval :

And it will move to Accepted as soon as the form is accepted by Euronext.

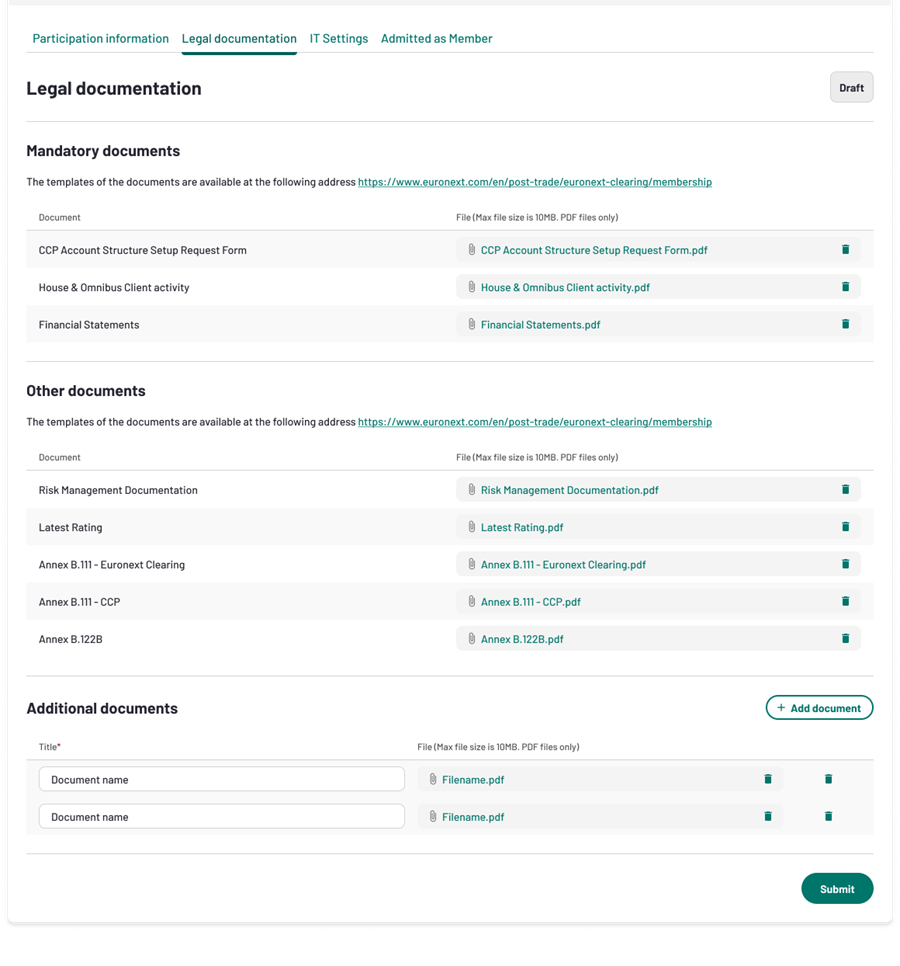

Legal Documentation

On the Legal documentation form, you will have to upload the following mandatory documents :

- CCP Account Structure Setup Request Form

- House & Omnibus Client acitivity

- Financial Statements

- Any other relevant legal documents needed

When all the legal documents needed are uploaded and submitted, the status of the legal documentation will move from draft to pending review and will be reviewd by Euronext.

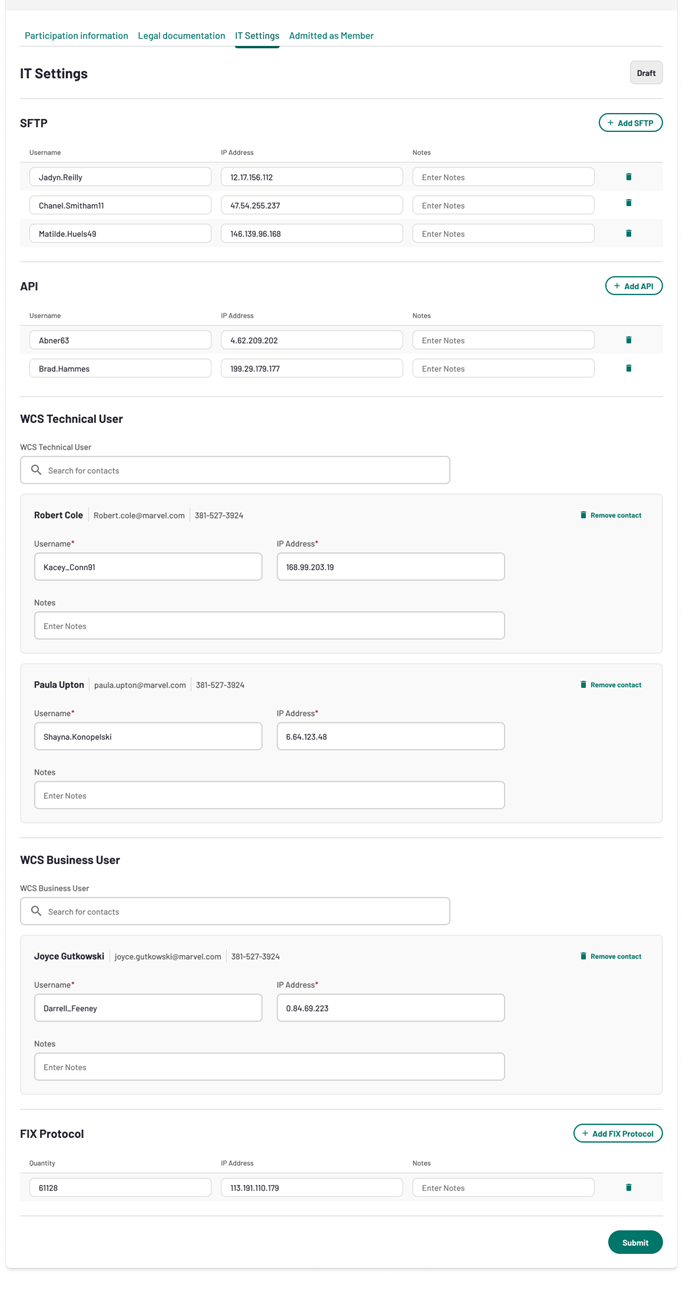

IT Settings

This form allows to configure all the IT settings needed for the onboarding. You will have to fill-in the following mandaotry information:

- SFTP

- API

- WCS Technical User

- WCS Business User

- FIX Protocol

Once the IT settings form is submitted, its status will move from draft to pending review and will be reviewd by Euronext.

Euronext will review all the forms listed above and approve the Admission stage. Once this stage is approved, its status will change to Completed. The Applicant will receive an official Admission Letter as confirmation.